Passenger arrivals at the Kotoka International Airport (KIA) have declined by 8.5% year-on-year, signalling a slowdown in inbound travel to Ghana during the first half of 2025. The Bank of Ghana’s September 2025 Monetary Policy Report revealed that international passenger arrivals fell from 121,995 in July 2024 to 111,631 in July 2025, a notable dip amid global and domestic economic shifts.

According to the report, while July’s year-on-year decline was significant, the short-term trend appeared more stable, with a 3% month-on-month increase compared to June 2025. Cumulatively, arrivals between January and July 2025 dropped marginally to 722,020 compared to 724,412 during the same period in 2024 — a reduction of about 0.3%.

The report attributed part of the decline to reduced inbound tourism and slower international business travel, factors linked to Ghana’s ongoing macroeconomic adjustment measures, currency depreciation, and tighter fiscal policies that have affected travel confidence and affordability. Analysts also point to higher airline ticket prices and fewer charter flights from key routes, particularly from Europe and Asia, as contributing factors.

Despite the reduction in air passenger inflows, the Bank of Ghana observed positive developments in other sectors of external trade, particularly in maritime logistics. International trade activity through the country’s two main ports, Tema and Takoradi, improved significantly over the same period.

The data shows that laden container traffic, a key indicator of trade performance, rose by 28.9% year-on-year to 75,183 containers in July 2025, compared to 58,330 recorded in July 2024. Cumulatively, container throughput at both ports surged by 23.8% in the first seven months of 2025, reaching 497,292 compared with 401,845 for the same period last year.

This growth in maritime activity underscores the ongoing recovery of Ghana’s external sector, buoyed by rising import volumes of industrial materials, oil and gas logistics, and re-exports to the subregion. The uptick also reflects improved port infrastructure, digitalisation of customs processes, and stronger trade relations within the Economic Community of West African States (ECOWAS).

However, aviation experts have expressed concern that declining passenger traffic may have broader implications for Ghana’s tourism and hospitality industry. According to them, the fall in arrivals could signal reduced foreign exchange inflows from travel and leisure activities, impacting hotels, car rental services, and small tourism-related enterprises.

Economists suggest that sustaining Ghana’s aviation and tourism rebound requires targeted marketing campaigns, easing travel restrictions, and reducing operational costs for airlines operating within the country. “Ghana remains a key West African hub, but competition from regional airports like Lagos and Abidjan is growing fast. We must maintain competitive pricing and infrastructure standards to sustain traffic through KIA,” a transport analyst in Accra noted.

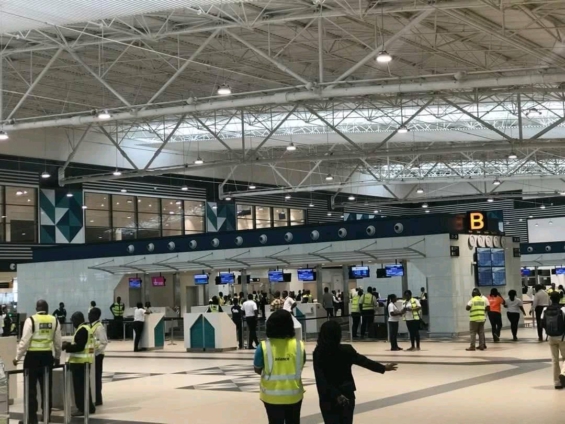

The Ghana Airports Company Limited (GACL) has in recent months intensified efforts to attract more airlines and promote KIA as a preferred transit hub in the subregion. New routes from Middle Eastern and East African carriers are being negotiated to diversify source markets and mitigate the impact of reduced European inflows.

While the Bank of Ghana report highlighted the short-term dip, it also emphasised that the aviation sector could rebound as the global travel environment stabilises and domestic economic recovery strengthens. With improving foreign reserves, stable inflation, and the gradual easing of fiscal pressures, Ghana’s medium-term travel and trade outlook remains cautiously optimistic.

The government’s continued investment in airport expansion, including upgrades at Tamale and Kumasi airports, is also expected to contribute to long-term resilience. By enhancing regional connectivity and supporting tourism development, these initiatives aim to spread economic benefits beyond the capital.

As Ghana pushes toward full economic recovery, the balance between air travel and maritime trade will remain a crucial indicator of external sector performance. While air arrivals have slowed, the surge in port activity suggests that the country’s trade backbone remains strong, positioning Ghana for a more diversified recovery path in the years ahead.

Passion Air announces significant flight disruptions over fuel shortage