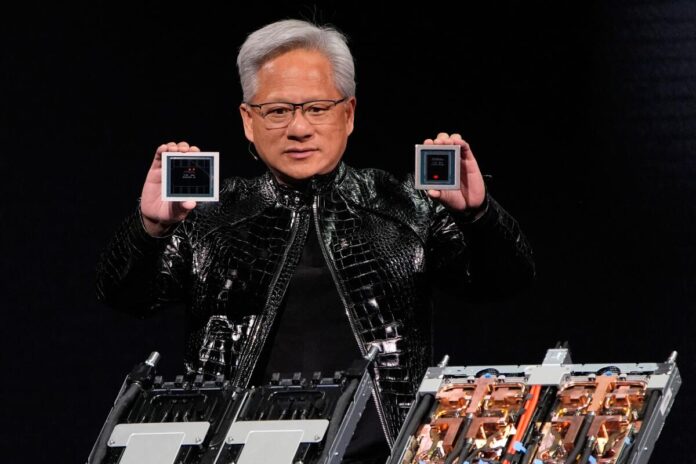

The recent US approval of Nvidia chip sales to China marks a significant recalibration of Washington’s approach to technology exports, global competition, and economic leverage. After months of uncertainty, the US Commerce Department’s decision to allow Nvidia to resume sales of its H200 artificial intelligence processors to China reflects a pragmatic shift rather than a full policy reversal. While the most advanced Blackwell chips remain restricted, the move signals a willingness to balance national security concerns with economic realities.

At its core, the US approval of Nvidia chip sales to China underscores how deeply intertwined global semiconductor supply chains have become. Artificial intelligence development is no longer confined to national borders; it is driven by scale, data access, and computational power. By allowing limited access to advanced chips, Washington is attempting to manage, not halt, China’s AI progress while protecting US industrial interests.

Economic logic behind the US approval of Nvidia chip sales to China

From a business perspective, the US approval of Nvidia chip sales to China offers a release valve for one of America’s most strategically important companies. China has historically accounted for a substantial share of Nvidia’s data-centre revenue. Prolonged restrictions risked leaving excess inventory, weakening earnings, and encouraging Chinese firms to accelerate domestic alternatives.

The conditional approval, requiring sufficient domestic supply and verified civilian use, allows the US to maintain oversight while preventing Nvidia from being sidelined in the world’s second-largest technology market. President Donald Trump’s proposal to collect a 25% fee from approved sales also introduces a new form of economic statecraft, turning export permissions into a revenue-generating instrument rather than a binary restriction.

For US manufacturers and workers, Nvidia’s return to the Chinese market supports production volumes, supply-chain stability, and employment across fabrication, logistics, and supporting industries.

How the decision affects global businesses and supply chains

The US approval of Nvidia chip sales to China reverberates well beyond the semiconductor sector. For multinational firms reliant on AI, from cloud computing providers to pharmaceutical researchers, greater availability of high-performance chips helps stabilise pricing and reduce supply bottlenecks.

Chinese technology companies, meanwhile, gain temporary relief as they bridge the gap between current needs and future domestic capabilities. While Beijing continues to push for semiconductor self-sufficiency, access to H200 chips allows firms to remain competitive in areas such as autonomous systems, financial modelling, and consumer AI services.

However, this dynamic also reinforces a two-tier AI ecosystem: cutting-edge development remains centred in the US and allied markets, while China operates with slightly constrained, but still powerful, tools.

Household-level implications of the US approval of Nvidia chip sales to China

Although the US approval of Nvidia chip sales to China may appear distant from everyday life, its effects eventually reach households. AI-driven efficiencies influence everything from consumer electronics prices to logistics costs and healthcare diagnostics.

Stable chip supply helps keep the cost of AI-enabled services, such as smart devices, digital banking tools, and online platforms, from escalating sharply. For households, this translates into more affordable technology, better service delivery, and slower inflationary pressure in tech-heavy sectors.

In the US, sustained semiconductor demand also supports job security in advanced manufacturing hubs, indirectly strengthening household incomes and regional economies.

Geopolitics and the strategic limits of the approval

Despite the apparent easing, the US approval of Nvidia chip sales to China does not signal a thaw in broader US–China relations. Export controls remain firmly in place for the most advanced processors, and Chinese buyers must comply with strict security assurances.

Beijing’s criticism of the “weaponisation of trade” highlights ongoing mistrust, while US officials continue to warn about potential military spillovers. The policy therefore reflects controlled engagement rather than reconciliation, an attempt to shape China’s technological trajectory without triggering economic self-harm.

Analysts note that this model may become a template for future trade negotiations, where access is granted selectively and monetised strategically.

A calculated compromise in the global AI race

Ultimately, the US approval of Nvidia chip sales to China represents a calculated compromise in an intensifying global AI race. It preserves American technological leadership while acknowledging the economic cost of isolationist controls. For Nvidia, it restores revenue streams at reduced margins; for China, it buys time; and for the US government, it creates leverage over both commerce and competition.

The long-term impact will depend on whether this approach slows China’s military AI ambitions without undermining America’s own innovation ecosystem. What is clear is that AI chips are no longer just commercial products; they are instruments of economic power, diplomacy, and global influence.