Government treasury auction demand strengthened notably in the latest auction, with total bids exceeding the government’s target by more than 20 percent. This oversubscription reflects growing investor confidence in short-term government securities at a time when market participants remain cautious about broader economic risks. The scale of participation suggests that investors are increasingly comfortable locking funds into state-backed instruments, viewing them as a safe and predictable store of value.

The higher-than-targeted uptake also points to ample liquidity within the financial system. When Treasury bill subscription levels rise sharply, it often signals that investors, particularly banks and institutional players, are prioritising capital preservation over riskier private-sector lending.

Why Treasury bill subscription levels matter for fiscal and monetary conditions

At the policy level, government treasury auction demand matters because it directly affects government financing costs and liquidity management. Oversubscribed auctions give authorities greater flexibility in meeting short-term funding needs without aggressively pushing yields higher. This can help stabilise debt servicing costs, especially in an environment where fiscal discipline remains under close scrutiny.

From a monetary policy perspective, elevated Treasury bill subscription levels also provide insight into market expectations. Strong participation indicates confidence that inflation is moderating and that yields offered on treasury bills remain attractive in real terms. It further suggests that investors expect relative stability in interest rates over the near term.

Yield movements and government treasury auction demand dynamics

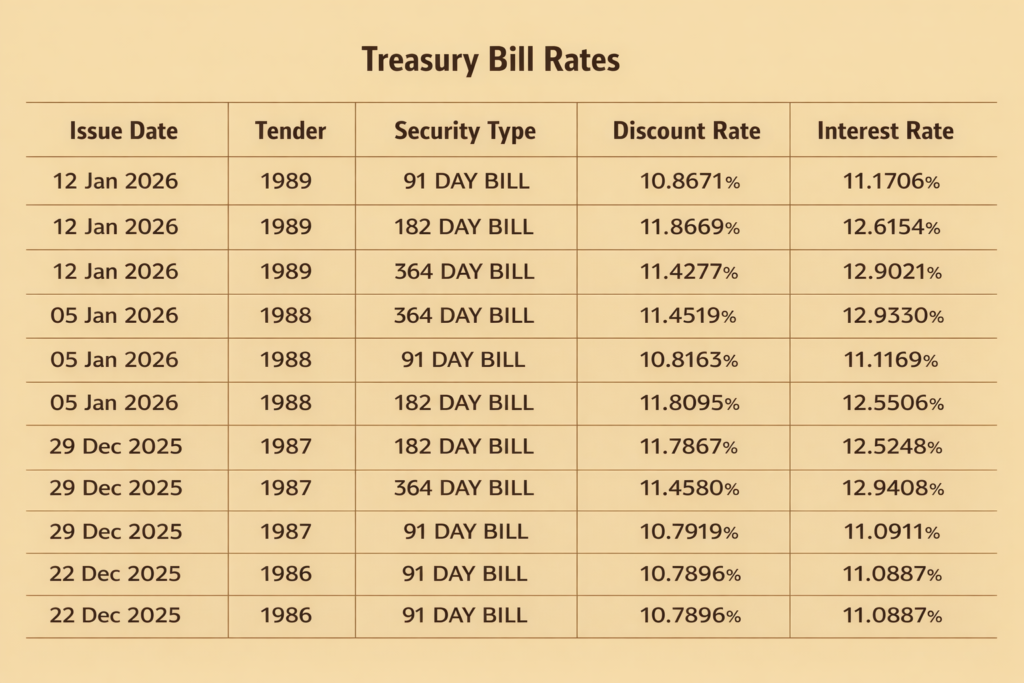

The interaction between government treasury auction demand and yields reveals important nuances. While demand was robust across maturities, yields on shorter-dated instruments edged upward, reflecting competition among bidders and expectations of near-term liquidity conditions. The modest rise in short-term yields suggests investors are still pricing in some uncertainty around inflation and monetary policy direction.

Conversely, the decline in yields on longer-dated bills indicates that government treasury auction demand is increasingly driven by investors seeking to lock in returns ahead of potential easing in financial conditions. This divergence points to a market that is cautiously optimistic about medium-term macroeconomic stability.

Household implications of government treasury auction demand

For households, government treasury auction demand has indirect but meaningful implications. Treasury yields influence broader interest rate conditions, including returns on savings instruments and fixed-income investment products. As demand strengthens and yields stabilise, households with exposure to money market funds or treasury-backed savings products may benefit from predictable returns.

However, strong government treasury auction demand can also crowd out private-sector credit if banks channel excess liquidity into government securities rather than consumer lending. This may limit access to affordable loans for households in the short term, even as macroeconomic stability improves.

Business impact of government treasury auction demand

For businesses, particularly small and medium-sized enterprises, government treasury auction demand serves as a barometer of credit conditions. High demand for government paper often signals risk aversion within the banking sector, as lenders favour low-risk sovereign instruments over private lending. This can constrain access to working capital and investment finance, especially for firms without strong balance sheets.

On the positive side, sustained government treasury auction demand supports macroeconomic stability by easing government financing pressures. A more stable fiscal environment reduces the likelihood of abrupt policy adjustments, which can disrupt business planning. Over time, improved confidence in public debt markets may translate into lower systemic risk premiums.

Liquidity signals embedded in government treasury auction demand

Another key takeaway from the auction results is the liquidity signal embedded in government treasury auction demand. Strong participation across maturities suggests that financial institutions are holding sufficient cash buffers and are actively reallocating funds. This liquidity, if conditions permit, could eventually flow into private credit markets once risk perceptions ease.

The composition of demand also matters. Dominance of short-term instruments indicates a preference for flexibility, while sustained interest in longer tenors suggests confidence in economic direction. Together, these trends reinforce the informational value of Treasury bill subscription levels as a real-time indicator of market sentiment.

Why government treasury auction demand matters going forward

Ultimately, Treasury bill subscription levels are more than a snapshot of investor behaviour; it is a reflection of confidence, liquidity, and expectations across the economy. For policymakers, it offers reassurance that government funding needs can be met without destabilising markets. For households, it influences savings returns and credit availability. For businesses, it shapes borrowing conditions and investment planning.

As Ghana navigates its recovery path, sustained government treasury auction demand, combined with disciplined fiscal and monetary policy, could help anchor stability and gradually restore risk-taking in the private sector.

BoG lending rate target of 10% signals a strategic shift toward cheaper credit