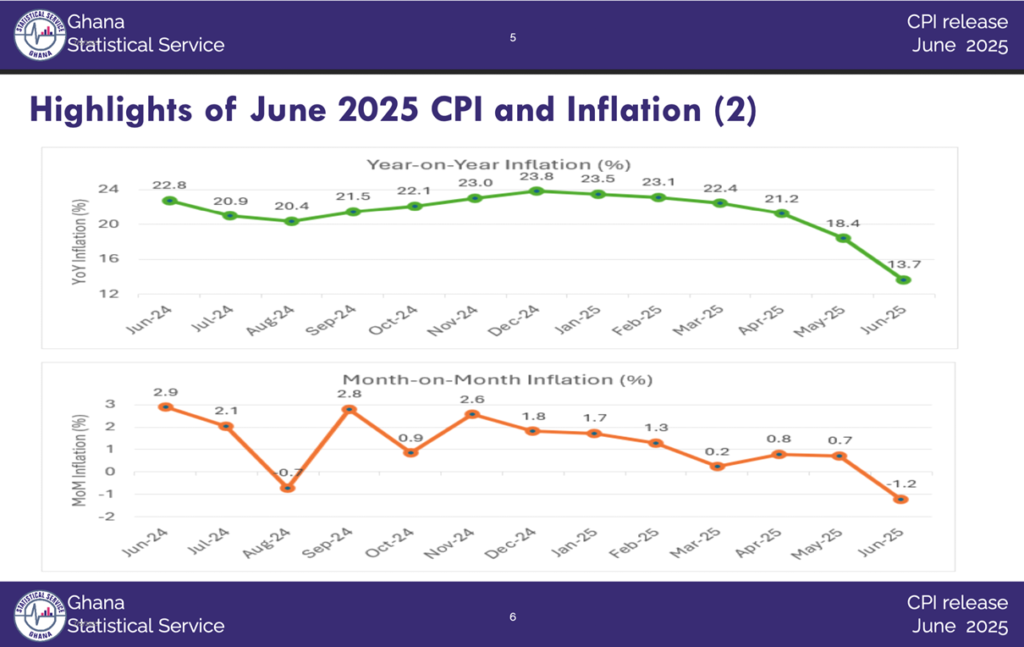

Ghana’s inflation decline to 5.4 percent in December 2025 marks one of the most significant macroeconomic shifts the country has recorded in recent years, closing a turbulent inflationary chapter that peaked at 23.8 percent in December 2024. Beyond the headline number, the data reveal a deeper story about stabilising prices, easing cost pressures, and a gradually improving environment for households and businesses alike.

Why the Ghana’s Inflation Decline Matters

The Ghana’s inflation decline is important because inflation directly shapes purchasing power, investment decisions, and overall economic confidence. A sustained 12-month disinflation trend signals that price pressures are no longer systemic but increasingly contained. This is not a temporary correction driven by one-off factors, but a broad-based slowdown across food, non-food, goods, services, and both local and imported products.

At 5.4 percent, inflation is now at its lowest level since the consumer price index was rebased in 2021. For policymakers, this strengthens credibility around macroeconomic management. For the private sector, it introduces predictability, which is often more valuable than rapid growth.

Household Impact of Ghana’s Inflation Decline

For households, the Ghana’s inflation decline translates into real relief, particularly through food prices, which account for roughly 43 percent of household spending. Food inflation fell sharply to 4.9 percent year-on-year in December 2025, down from 27.8 percent a year earlier. This nearly 23 percentage-point decline eases pressure on disposable incomes, especially for low- and middle-income families.

While month-on-month food prices still rose by 1.1 percent due to seasonal supply pressures, these increases now occur within a stable price environment rather than a runaway inflation cycle. This distinction matters: households can better plan spending, reduce precautionary hoarding, and allocate income toward education, healthcare, and savings.

Non-food inflation also cooled significantly, easing to 5.8 percent from over 20 percent a year earlier. This affects costs such as clothing, household goods, transport services, and utilities, gradually restoring balance to household budgets.

What the Ghana’s Inflation Decline Means for Businesses

Ghana’s inflation decline has equally important implications for businesses. Slower goods inflation, now at 5.8 percent compared with 23.1 percent a year earlier, reduces input cost volatility for manufacturers, traders, and retailers. With nearly three-quarters of the CPI basket tied to goods, this moderation improves margins and pricing strategies.

For service providers, inflation remains slightly elevated month-on-month, but the annual trend is clearly downward. Services inflation dropped from 15.4 percent in December 2024 to 4.5 percent in December 2025, allowing firms to reconsider expansion plans that were previously shelved due to cost uncertainty.

Lower inflation also improves access to credit over time, as declining price pressures reduce the need for aggressive monetary tightening. This can encourage capital investment, inventory restocking, and longer-term contracts.

Local and Imported Prices Tell a Broader Story

The breadth of the Ghana’s inflation decline is evident in both locally produced and imported items. Inflation for locally produced goods slowed to 5.9 percent, reflecting improved domestic supply conditions and better cost control. Imported inflation eased to 4.3 percent, suggesting reduced external price pressures and a more stable exchange-rate environment.

This dual moderation is critical. When both domestic and imported prices ease simultaneously, inflation shocks become less likely to resurface abruptly, reinforcing economic stability.

Regional Differences and Uneven Benefits

Despite the national trend, the Ghana’s inflation decline is not evenly distributed. Regional data show disparities linked to infrastructure, storage, transportation, and market access. The Eastern Region recorded the highest inflation at 11.2 percent, while the Savannah Region experienced outright deflation at minus 1.2 percent.

Five regions, Greater Accra, Ashanti, Eastern, Central, and Western, accounted for more than 80 percent of overall inflation, underscoring how population density and commercial activity shape price behaviour. For businesses operating nationwide, these variations affect pricing, logistics, and location-specific investment decisions.

The Bigger Economic Signal

Ultimately, the Ghana’s inflation decline sends a powerful signal: price stability is returning after a period of extreme stress. While month-on-month volatility remains, the long-term direction is clear. If sustained, this environment can rebuild confidence, support job creation, and improve living standards.

However, maintaining this progress will require disciplined fiscal management, continued supply-side reforms, and careful monitoring of regional disparities. Inflation may be under control, but expectations must remain anchored to prevent reversals.

Banking Regulator Tightens Supervision to Strengthen Financial Sector Stability