In Africa’s modern economic landscape, currency strength is no longer a dry statistic confined to central bank reports. By the end of 2025, exchange-rate performance had become a visible signal of how effectively governments managed inflation, external shocks, and investor confidence in a year marked by global monetary tightening and uneven commodity cycles.

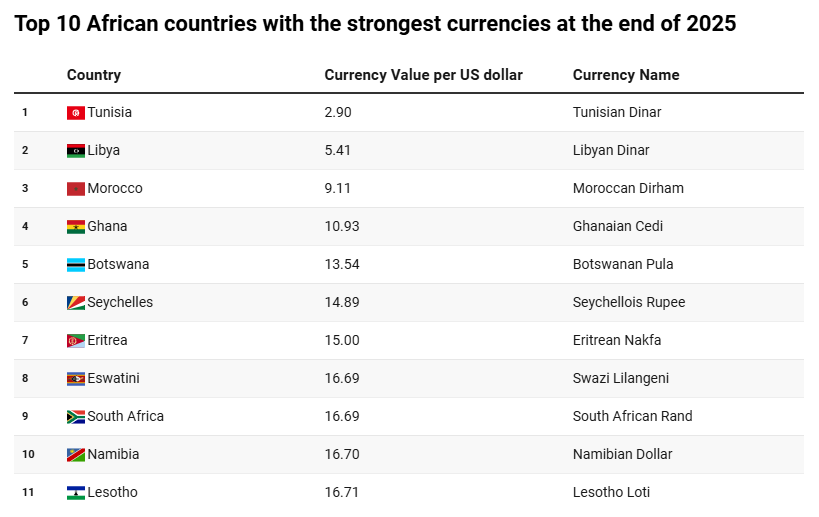

Data tracking currency performance across the continent reveals that a handful of African currencies of some African countries have stood out for their relative strength and resilience. Among them, South Africa, Ghana, and Zambia recorded notable appreciation of their African currencies against the US dollar, reversing or moderating earlier years of sustained depreciation. While the headline figures differ by source, ranging from market data to estimates referenced by the World Bank and private financial calculators, the direction of travel is clear: currency outcomes in 2025 increasingly reflected policy credibility rather than luck alone.

South Africa’s rand appreciated by more than 12% during 2025, supported by firmer commodity prices, particularly precious metals, alongside improved fiscal discipline and a more credible inflation-fighting stance by the central bank. The appreciation eased import pressures in an economy heavily reliant on imported fuel and capital goods, offering temporary relief to both households and firms.

Ghana’s cedi posted an even sharper rebound, gaining more than 20% year-to-date after losing significant ground in 2024. This recovery followed a period of aggressive fiscal consolidation, tight monetary policy, and improved foreign exchange inflows from cocoa and gold exports. Zambia’s kwacha also strengthened by around 16%, buoyed by progress in debt restructuring, lower oil import costs, and improved foreign currency liquidity.

These figures highlight an important shift: in 2025, Africa’s strongest currencies were not necessarily those with the highest nominal value, but those backed by improving fundamentals and clearer policy direction.

The appreciation of the African currencies carries immediate macroeconomic implications. A stronger currency lowers the cost of imports, helping to moderate inflation in economies where food, fuel, and manufactured goods are largely sourced from abroad. For households, this can translate into slower increases in the cost of living. For governments, it reduces the local-currency burden of servicing external debt.

However, the benefits are uneven. Exporters can face pressure as stronger currencies make goods less competitive abroad, particularly in non-commodity sectors. This trade-off underscores why sustained currency strength must be managed carefully rather than celebrated uncritically.

For African businesses, exchange-rate stability is often more valuable than outright strength. In South Africa, a firmer rand reduced input costs for manufacturers and retailers dependent on imports, improving margins in a challenging consumer environment. In Ghana and Zambia, currency gains helped stabilise pricing for businesses that had struggled with volatile import costs in previous years.

Foreign investors also tend to reward currency stability. Countries where exchange-rate risks appear more manageable attract longer-term capital, particularly into sectors such as mining, financial services, and infrastructure. In contrast, markets with sharp currency swings face higher risk premiums, raising borrowing costs for firms and governments alike.

Viewed through a market lens, the strongest African currencies in 2025 reveal both opportunity and vulnerability. Commodity exporters benefited disproportionately from higher global prices, but this exposes them to reversal if those prices soften. Fiscal discipline and credible monetary policy emerged as decisive factors, suggesting that currency strength is increasingly policy-driven rather than cyclical.

At the same time, strong currency performance does not imply immunity from risk. Many of the gains recorded in 2025 followed sharp losses in earlier years, making part of the appreciation corrective rather than transformative.

Several risks could undermine currency strength going forward. A slowdown in global growth would weigh on commodity prices, eroding export earnings. Renewed capital outflows, triggered by changes in US interest rates or geopolitical shocks, could quickly reverse gains. Domestically, election cycles, fiscal slippage, or delays in reform implementation remain persistent threats.

There is also the risk of overvaluation. If currencies strengthen faster than productivity growth, export competitiveness may suffer, undermining long-term growth prospects.

Investors and businesses assessing African currencies risk in 2026 should closely monitor several indicators:

- Commodity price trends, especially for gold, oil, and agricultural exports.

- Central bank policy signals, including interest rate decisions and inflation targets.

- Fiscal performance, particularly deficits and debt servicing costs.

- External financing flows, including portfolio investment and multilateral support.

- Political timelines, such as elections that may influence fiscal discipline.

The experience of the strongest African currencies in 2025 underscores a broader lesson: currency performance is increasingly a referendum on economic governance. While stronger currencies can offer short-term relief and attract capital, sustaining those gains will require continued policy credibility, diversified export bases, and resilience to global shocks. For businesses and investors, the opportunity lies not in chasing appreciation alone, but in identifying markets where stability is underpinned by durable reform rather than temporary tailwinds.

Ghana Remains Africa’s Top Gold Producer, Ranked 6th Globally