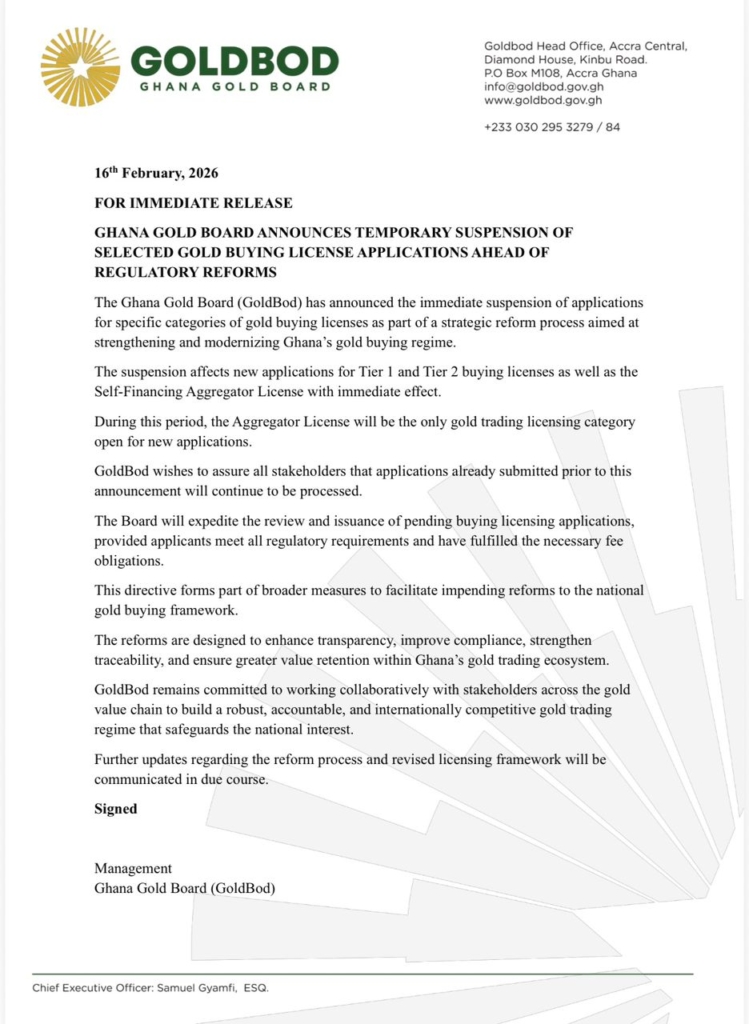

The Gold buying licence suspension announced by the Ghana Gold Board marks a decisive shift in how the country intends to regulate and monetise its gold trade. With immediate effect, applications for Tier 1, Tier 2 and Self-Financing Aggregator licences have been halted, as authorities push ahead with sweeping reforms aimed at modernising Ghana’s gold buying framework.

The Gold buying licence suspension does not affect applications already submitted, and the Aggregator Licence category remains open. Still, the decision signals a pause in expansion as regulators retool the system to address long-standing concerns around transparency, traceability and national value capture.

Why the Gold Buying Licence Suspension Matters

Ghana is one of Africa’s largest gold producers, with exports forming a cornerstone of foreign exchange earnings. Yet the sector has faced persistent challenges, including smuggling, under-declaration of volumes and limited domestic value retention. The Gold buying licence suspension suggests regulators believe the existing licensing structure requires recalibration before new entrants are allowed in.

By freezing certain categories, the Ghana Gold Board is creating room to tighten compliance standards and close loopholes that may have enabled revenue leakage. In resource-dependent economies, even small inefficiencies in trading systems can translate into substantial fiscal losses. The Gold buying licence suspension therefore reflects broader efforts to strengthen oversight and boost national benefit from mineral resources.

The reform drive comes at a time when global gold prices remain volatile and geopolitical uncertainties continue to shape commodity markets. For Ghana, ensuring that its gold trade operates transparently is critical not only for investor confidence but also for macroeconomic stability.

Business Implications of the Gold Buying Licence Suspension

For licensed gold buyers and aggregators, the Gold buying licence suspension introduces short-term uncertainty. Firms planning expansion under Tier 1 or Tier 2 categories may now face delays in scaling operations. Prospective entrants must wait for revised guidelines, potentially slowing competition in the interim.

However, for established operators who meet compliance standards, the Gold buying licence suspension could ultimately reduce market distortions. A more robust licensing regime may weed out weak or non-compliant players, fostering a more credible and structured trading environment.

Banks and export financiers will also be watching closely. Gold-backed transactions rely on accurate reporting and verifiable supply chains. If reforms strengthen traceability and documentation, lenders may gain greater confidence in underwriting gold-related trade finance. In that sense, the Gold buying licence suspension could pave the way for improved access to formal financing in the long run.

How the Gold Buying Licence Suspension Affects Households

While regulatory changes may appear technical, the Gold buying licence suspension carries implications for households, particularly in mining communities. Small-scale miners often depend on licensed buyers to sell their output. If licensing bottlenecks reduce the number of active buyers temporarily, miners could face reduced bargaining power or delays in payments.

On the other hand, stronger oversight may help stabilise incomes over time. Improved traceability and compliance can reduce the prevalence of illegal intermediaries who exploit miners through underpricing or opaque deductions. If reforms succeed, the Gold buying licence suspension could contribute to fairer transactions and higher retained earnings for local producers.

Nationally, gold export revenues influence government budgets, exchange rate stability and public spending capacity. When leakages occur, households indirectly bear the cost through weaker fiscal buffers and reduced social investment. By recalibrating the licensing regime, policymakers aim to ensure that gold revenues translate more effectively into development outcomes.

Transparency and Traceability at the Core

The Ghana Gold Board has framed the Gold buying licence suspension as part of a strategic modernisation process. Central to this effort is the enhancement of traceability systems. In global markets increasingly sensitive to ethical sourcing and anti-money laundering standards, buyers demand documentation that proves origin and compliance.

If Ghana strengthens its gold buying regime through digital tracking, stricter reporting and clearer tier definitions, it may improve its competitiveness in responsible sourcing markets. International refiners and bullion traders often prioritise jurisdictions with credible regulatory frameworks. The Gold buying licence suspension therefore positions reform as a pathway to long-term credibility.

The Gold buying licence suspension is less about restricting trade and more about resetting the rules that govern it. In the short term, the pause may slow new business activity and create transitional uncertainty. In the medium to long term, however, it signals a deliberate attempt to safeguard revenue, enhance compliance and modernise Ghana’s gold trading architecture.

For businesses, the development underscores the importance of regulatory alignment and operational transparency. For households, especially those in mining regions, it highlights the interconnectedness between governance reforms and income security.

Ultimately, the success of the Gold buying licence suspension will depend on the clarity and speed of the new framework. If the reforms deliver improved oversight without stifling legitimate trade, Ghana could strengthen both investor confidence and domestic value retention in one of its most strategic sectors.