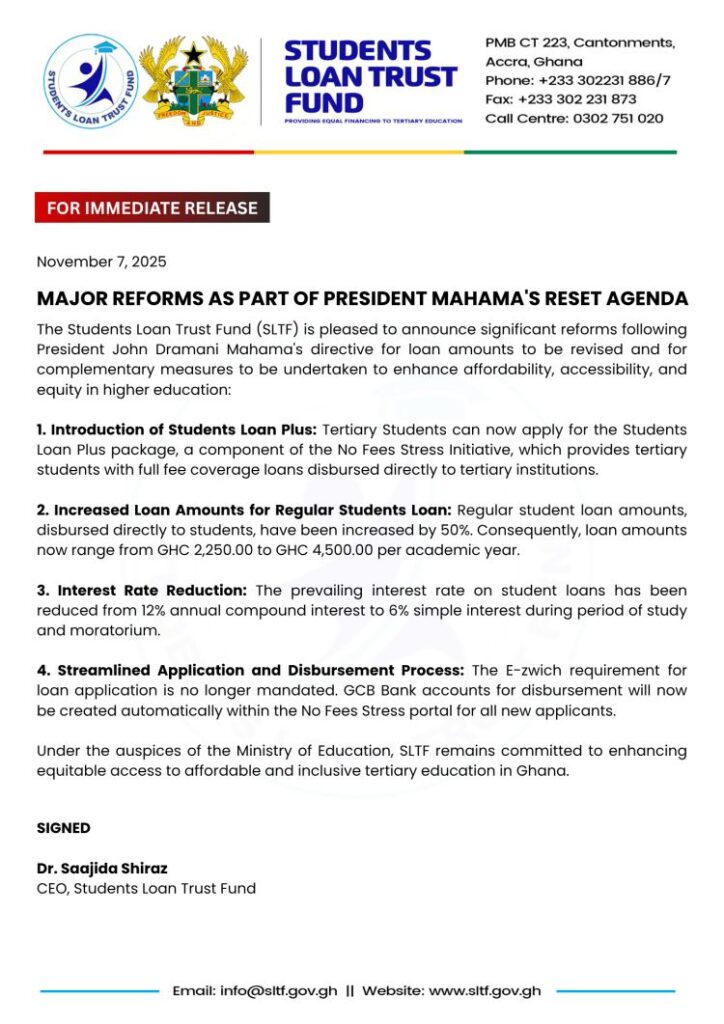

The Students Loan Trust Fund (SLTF) has announced a major policy shift aimed at easing the financial burden on Ghanaian tertiary students. Effective immediately, the Fund has reduced its annual interest rate from 12% compound to 6% simple interest for the duration of a student’s course and grace period.

The policy, which forms part of President John Dramani Mahama’s broader “Reset Agenda,” is designed to make tertiary education more affordable, equitable, and accessible—particularly for students from low-income backgrounds.

Key Details of the New Student Loan Policy

According to a press release issued on November 7, 2025, and signed by the Chief Executive Officer of SLTF, Dr. Saajida Shiraz, the new interest structure will apply throughout the study period and moratorium, easing repayment terms for beneficiaries.

Under the revised framework:

- The previous 12% annual compound interest has been cut to 6% simple interest.

- Loan amounts for regular students have been increased by *50%, with disbursements now ranging from *GH₵2,250 to GH₵4,500 per academic year.

- Payments will continue to be made directly to students, enhancing transparency and access.

Dr. Shiraz described the change as a significant step toward building an inclusive tertiary education financing system that aligns with Ghana’s national human capital development goals.

“Under the auspices of the Ministry of Education, SLTF remains committed to ensuring equitable access to affordable tertiary education in Ghana,” she stated.

The reform follows an earlier announcement by *Minister of Education Haruna Iddrisu, who hinted at the government’s plan to replace compound interest with a simpler model. Addressing the *Public Accounts Committee (PAC) on November 3, the Minister said the old interest policy had placed an undue financial strain on graduates, particularly those who remained unemployed after completing school.

He explained that many students were accumulating large repayment burdens due to interest compounding over the study and post-graduation periods. “The compound interest system was inherently unfair to unemployed graduates. The shift to a simple interest rate will make repayment fairer and more predictable,” Mr. Iddrisu said.

Access to tertiary education remains one of the biggest determinants of economic mobility in Ghana. However, the rising cost of tuition, accommodation, and learning materials has made higher education increasingly unaffordable for many students, particularly in public universities.

The reduction in loan interest and the increase in loan disbursement are expected to cushion students against inflation and rising living costs while supporting the government’s goal of expanding tertiary enrollment.

Education policy analysts note that Ghana’s tertiary gross enrollment ratio currently stands at around *20%, below the *African Union’s target of 50% by 2063. By easing financing conditions, Ghana may be better positioned to close this gap.

This move also aligns with the global push for more equitable student financing models, as seen in Kenya, South Africa, and Botswana, where student loan interest rates have been adjusted to reflect post-pandemic economic realities.

Student groups have largely welcomed the announcement. The National Union of Ghana Students (NUGS) described the decision as “a timely and humane reform” that could ease the anxiety of students and graduates struggling with debt repayment.

A NUGS spokesperson, speaking to JoyNews, said, “Many graduates leave school with little to no income and are immediately burdened by growing loan balances due to compound interest. This change shows that the government is listening.”

However, some financial analysts have urged caution, noting that while the policy is well-intentioned, sustainability will depend on improved recovery mechanisms and effective monitoring.

“Reducing interest rates is positive, but the SLTF must also strengthen its recovery systems to avoid repayment defaults,” said education finance expert Dr. Kojo Frimpong. He added that the Fund could consider flexible repayment options tied to income levels to make the policy more sustainable.

Established in 2005 under the Students Loan Trust Fund Act (Act 820), the SLTF was created to provide financial assistance to Ghanaian students pursuing accredited tertiary programmes. The Fund currently serves tens of thousands of students across public and private universities, colleges of education, and technical universities.

Over the years, the SLTF has undergone several policy reviews aimed at improving loan accessibility and recovery rates. The introduction of biometric verification in 2023 and digital repayment platforms in 2024 were key milestones in modernizing its operations.

The latest reform, according to officials, is part of a broader restructuring process that includes exploring new funding streams and strengthening partnerships with financial institutions.

Analysts say the new loan policy could have ripple effects beyond the education sector. By reducing student debt burdens, it may stimulate entrepreneurship and youth participation in the labour market. Graduates with lighter repayment obligations are more likely to start small businesses, invest in further training, or contribute more actively to the economy.

At the same time, the reform demonstrates Ghana’s continued investment in human capital development—an essential ingredient for achieving sustainable growth and global competitiveness.

Across Africa, similar reforms are being pursued as governments seek to balance student support with fiscal responsibility. For instance, Nigeria recently reviewed its student loan scheme to allow repayment only after employment, while Kenya’s Higher Education Loans Board (HELB) has introduced income-contingent repayment plans.

The SLTF’s 6% simple interest policy marks a pivotal moment in Ghana’s higher education financing landscape. While challenges remain—especially in loan recovery and fund sustainability—the reform sends a strong message about the government’s commitment to inclusive and affordable education.

As more young Ghanaians aspire to tertiary education, such initiatives could help bridge inequality gaps and empower the next generation to drive innovation and development across the continent.

Read also: Mahama Urges African Unity in Disaster Relief as Ghana Sends GH₵10m Aid to Jamaica, Cuba, and Sudan