Table of Contents

Ghana’s New E-Commerce Bill to Strengthen Consumer Rights and Digital Market Trust

Ghana’s Parliament is considering a landmark Electronic Transactions Bill, 2025, which could overhaul the country’s online business environment by placing stronger protections in the hands of consumers. The legislation introduces new standards for transparency, data privacy, and digital payments — marking Ghana’s most comprehensive effort yet to regulate e-commerce.

Key Features of the Bill

Under the proposed law, online sellers will be required to disclose their legal names, business registration numbers, physical addresses, and refund policies on all sales platforms. The goal is to eliminate the anonymity that has allowed fraudulent or unregistered businesses to thrive on social media marketplaces.

The Bill also grants consumers the right to cancel an order within 14 days of receiving goods — or within seven days for digital services — and receive a full refund. Businesses that send unsolicited marketing messages without consent could face fines of up to ₵60,000 or imprisonment of up to 10 years, according to the draft provisions.

To improve financial safety, online retailers and payment processors will also be held liable for customer losses if their payment systems are found to be insecure. Additionally, banks and fintech firms will be prohibited from selling or sharing customers’ payment data without prior consent, strengthening Ghana’s digital privacy framework.

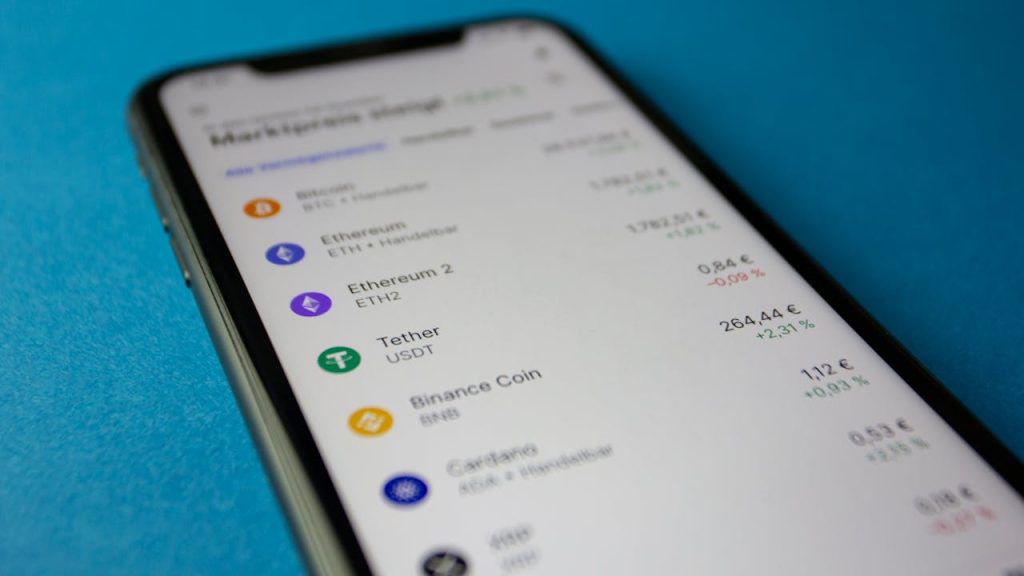

Ghana’s e-commerce industry has grown rapidly over the past five years, driven by smartphone penetration, mobile money, and youth entrepreneurship. According to Statista (2025), the local e-commerce market is valued at over US$1.4 billion, with projections to double by 2030.

However, the boom has come with rising concerns about fake sellers, online scams, and weak refund policies — issues that have discouraged some consumers from shopping online. The new Bill seeks to restore trust and align Ghana’s digital trade rules with international best practices such as the European Union’s Consumer Rights Directive.

“The aim is to create a fair and transparent environment where consumers can transact confidently online,” a senior official from the Ministry of Communications and Digitalisation said during stakeholder consultations.

Impact on Small Online Businesses

While consumer advocates have welcomed the Bill, some small and informal online vendors — particularly those selling through Instagram, TikTok, and WhatsApp — fear the new compliance requirements could raise their operational costs.

Industry analysts warn that stricter licensing, refund obligations, and data management rules could discourage micro-entrepreneurs or push informal sellers further underground. According to the Ghana Statistical Service, informal online trade contributes to roughly 60% of e-commerce activity in the country, often involving unregistered sellers.

To address these concerns, policy experts have called for a phased implementation and capacity-building support for small businesses to meet the new standards without disruption.

Towards a Safer Digital Marketplace

Consumer rights groups, including the Consumer Protection Agency (CPA), have praised the Bill as a long-overdue step toward ensuring accountability in Ghana’s online economy. “For too long, online buyers have had little recourse when things go wrong. This Bill finally changes that,” a CPA spokesperson noted.

The legislation also fits into Ghana’s broader Digital Economy Policy Framework, which aims to expand safe access to online services and boost investor confidence in digital trade. Similar efforts are emerging across Africa — from Kenya’s Data Protection Act to Nigeria’s Digital Rights and Freedom Bill — as countries modernize their e-commerce ecosystems.

Once passed, the Electronic Transactions Bill could make Ghana one of the region’s leaders in consumer-focused digital regulation. Lawmakers are expected to debate amendments to ensure that enforcement mechanisms are practical and do not stifle innovation.

As Ghana moves to balance innovation with consumer safety, the success of this Bill will depend on how effectively regulators enforce its provisions and support small businesses through the transition. If implemented well, it could mark a decisive step toward a safer and more trusted digital marketplace across Africa.

Read also: Revolutionary Crypto Virtual Cards Empower Africans and Transform KYC Barriers