CIB Ghana pioneers youth-led banking ethics challenge to tackle rising fraud

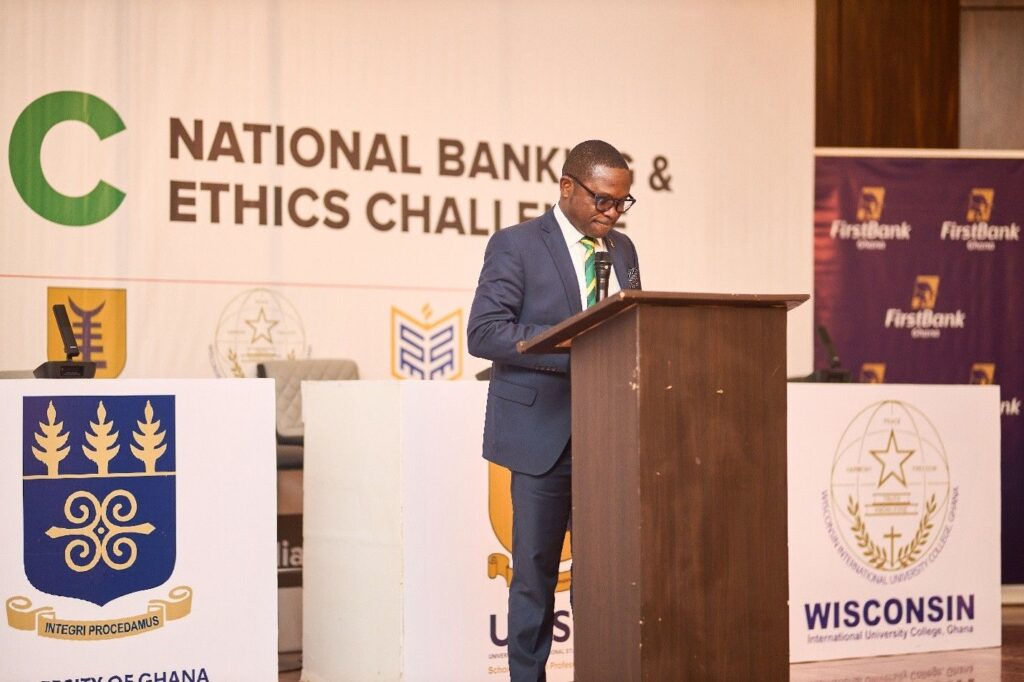

The Chartered Institute of Bankers (CIB) Ghana has held the maiden edition of the National Banking and Ethics Challenge (NBEC)—a pioneering competition aimed at promoting ethical banking practices among tertiary students. Held on Thursday, May 29, 2025, at the Institute’s auditorium in Accra, the event brought together five universities in a keenly contested quiz-style showdown centered on ethics, financial literacy, and professional conduct.

Universities Battle for Ethics Crown

Participating schools included:

- Academic City University College

- University of Ghana

- Pentecost University College

- University of Professional Studies, Accra (UPSA)

- Wisconsin International University College

The competition unfolded in three progressive stages: preliminaries, semifinals, and finals. At the end of the preliminary round, UPSA and Pentecost University College were eliminated, while Wisconsin exited at the semifinal stage.

The final round saw a fierce contest between Academic City University College and the University of Ghana, with Academic City emerging victorious.

Prizes and Recognition

Winners and other participants received plaques and cash prizes, while Academic City University was awarded a full scholarship to study a professional course at the Institute, along with other incentives.

Calls for Integrity in the Banking Sector

BoG Raises Alarm Over Fraud Increase

Delivering the keynote address, Head of the Financial Stability Department at the Bank of Ghana (BoG), Dr. Kwasi Osei Yeboah, commended CIB Ghana for its leadership in advancing ethics in banking.

He expressed concern over the rising trend of bank staff involvement in fraud, which increased from 274 in 2023 to 365 in 2024, representing a 33 percent rise.

“This disturbing trend contrasts sharply with the values expected of banking professionals,” he said, calling for urgent stakeholder collaboration to restore public trust.

He stressed that ethics must be embedded at every level of banking operations.

“Events like these are critical in nurturing a new generation of ethically minded bankers who uphold integrity and professionalism,” he added.

A Platform for Future Banking Leaders

CIB Ghana’s Vision for Ethical Leadership

CEO of CIB Ghana, Mr. Robert Dzato, underscored the importance of bringing banking education and financial literacy into schools, workplaces, and religious institutions.

“We all interact with money—so understanding how to manage it wisely, especially in an inflationary and dynamic economy, is essential for personal and national growth.”

“This challenge is not just a competition; it is a platform for our future banking professionals to engage with ethical standards that are crucial for the integrity of our financial system. We are proud to have initiated this event and look forward to making it an annual affair,” he added.

A Message to the Ghanaian Customer

Quiz Mistress and Fellow of the Institute, Doris Ahiati, said the NBEC serves three core audiences: the bank customer, the banking professional, and financial institutions.

“This challenge is our way of saying to the customer: we hear you. We are raising the bar in ethics and professionalism to rebuild your trust.”

She praised the participants for their enthusiasm and knowledge:

“It is encouraging to see young minds so dedicated to understanding the ethics of banking.”

CIB’s Ethical Mandate for the Future

Also speaking at the event, Vice President of CIB Ghana, Togbe Asiama Krakani V, described the challenge as a transformative initiative aligned with the Institute’s mandate to regulate banking practice and promote professional development.

“This is not just a contest—it is a call to action to embed ethics into the DNA of our future professionals and institutions,” he said.

A Step Toward a More Trustworthy Financial System

The maiden NBEC, held in partnership with JoyBusiness as the media partner, marks a significant step by CIB Ghana to entrench ethical values in banking from the classroom to the boardroom.

It also showcased the Institute’s commitment to building a sustainable, trustworthy, and resilient financial system in Ghana.

Read Also: Avoid Budget Blowouts: How Ghanaian Businesses Can Keep Cloud Costs Under Control