Figma, the collaborative design platform, saw its stock jump 15 percent following remarks from its Chief Financial Officer, who downplayed recent concerns about software market volatility and emphasized strong growth driven by artificial intelligence adoption. The company highlighted that its $100,000-plus annual customers, primarily enterprise clients, are increasingly leveraging Figma’s AI-enhanced tools, reinforcing its position in the competitive design software market.

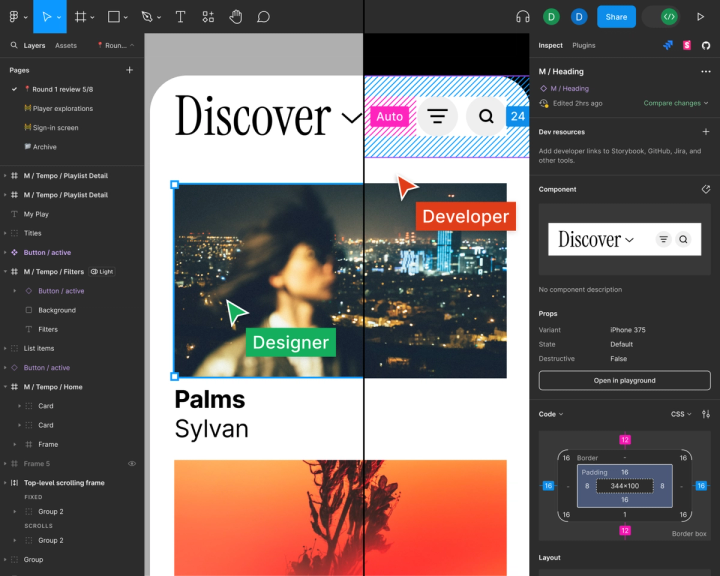

The CFO pointed to robust expansion in AI-powered features that streamline workflows, automate design iterations, and enhance collaboration across distributed teams. These capabilities, the company noted, have accelerated adoption among larger organizations, allowing Figma to capture more value from high-revenue accounts while attracting new enterprise clients seeking advanced design productivity solutions.

Despite broader apprehension in the software sector over market saturation and rising competition, Figma reported continued strength in customer retention and usage metrics. Executives emphasized that the company’s investment in AI tools, ranging from automated layout suggestions to generative design components, has differentiated it from competitors, driving deeper engagement among paying customers.

Industry analysts have pointed out that AI integration has become a key determinant for enterprise adoption in design and creative software, with organizations prioritizing platforms that reduce manual effort and enhance output quality. Figma’s approach, which allows teams to integrate AI features seamlessly into existing workflows, is seen as a major factor behind its recent stock performance.

The CFO also noted that while the wider design software market faces pressure from new entrants and evolving technologies, Figma’s focus on high-value customers mitigates risk. By targeting firms willing to pay premium subscriptions for AI-enhanced functionality, the company aims to sustain long-term revenue growth even amid broader market uncertainty.

Investor confidence appears to have been further bolstered by the company’s ongoing partnerships with technology providers and cloud platforms, enabling Figma to embed AI capabilities more deeply into enterprise environments. These integrations not only enhance product stickiness but also provide additional channels for customer expansion and upselling.

Market watchers say that Figma’s emphasis on monetizing its AI offerings could set a precedent for other SaaS companies facing similar headwinds. By demonstrating that artificial intelligence can drive engagement, retention, and revenue among top-tier clients, Figma is positioning itself to capture a larger share of the enterprise design software segment.

The stock rally underscores investor optimism that AI-driven growth can offset broader software sector volatility. For Figma, maintaining momentum will depend on continuous innovation, scaling AI adoption across its enterprise client base, and sustaining high renewal rates among its $100,000-plus customer cohort.