The Ghana Revenue Authority (GRA) has pushed back against concerns raised by the Abossey Okai Spare Parts Traders Association over the implementation of the new Value Added Tax regime under the Value Added Tax Act, 2025 (Act 1151).

In a press release dated February 10, 2026, the Authority said claims that the revised VAT structure would trigger higher consumer prices, distort market competition and unfairly burden spare parts dealers were based on a misunderstanding of how the new system operates.

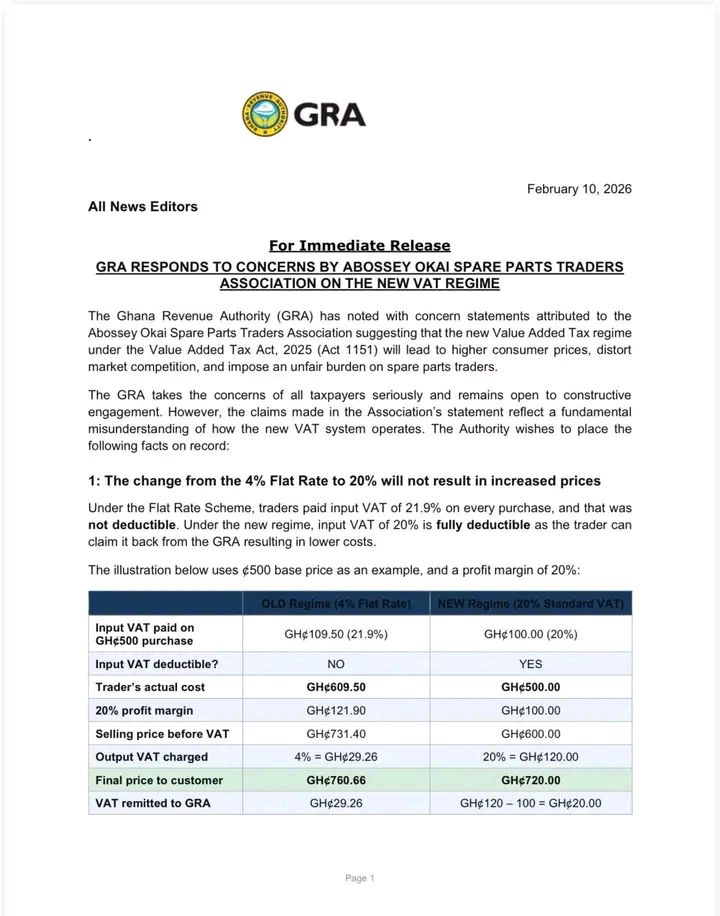

According to the GRA, the shift from the 4% Flat Rate Scheme to the 20% standard VAT regime does not automatically translate into higher prices. Under the previous flat rate system, traders paid 21.9% input VAT on purchases, which was non-deductible and formed part of their cost base. Under the new system, the 20% input VAT paid on purchases is fully deductible, meaning traders can claim it back when filing their returns.

Using an example of a GH¢500 base purchase with a 20% profit margin, the GRA explained that under the old regime, the trader’s cost rose to GH¢609.50 after including non-deductible input VAT. With profit and output VAT applied, the final price to the consumer reached GH¢760.66.

Under the new regime, the trader’s actual cost remains GH¢500 because the 20% input VAT is recoverable. After applying the same 20% profit margin and charging output VAT, the final consumer price stands at GH¢720, GH¢40.66 lower than under the previous system.

The Authority argued that perceived price increases stem from traders applying the 20% output VAT on top of a cost base that still includes input VAT, rather than adjusting for its deductibility.

The GRA also addressed concerns about the increased VAT registration threshold, which has been raised to GH¢750,000 in annual turnover. It said the change does not create competitive distortions. While non-registered traders cannot charge output VAT or claim input VAT, the Authority maintains that pricing outcomes remain effectively neutral when margins are properly calculated.

For instance, a non-registered trader purchasing goods valued at GH¢500 would bear a total cost of GH¢600 after VAT and, with a 20% margin, sell at GH¢720. A registered trader, whose cost base remains GH¢500 due to input VAT deductibility, would also arrive at a final consumer price of GH¢720 after applying output VAT.

Beyond addressing specific concerns, the GRA outlined broader benefits of the new VAT regime. These include a reduction in the overall effective rate from 21.9% to 20%, the permanent removal of the 1% COVID-19 Health Recovery Levy, full deductibility of input VAT including NHIL and GETFund levies, and the elimination of cascading tax effects where levies were previously charged on top of other levies.

The Authority said the reforms lower the cost of doing business by removing input VAT from traders’ cost bases, citing an almost 18% reduction in cost in the GH¢500 illustration. It also highlighted the simplification of the VAT structure through the abolition of the flat rate scheme and the higher registration threshold, which exempts smaller businesses from VAT compliance obligations.

The GRA acknowledged transitional challenges but attributed current price adjustments to misapplication of the new rules rather than structural flaws in the policy. It disclosed that a joint technical team has already been established with the Ghana Union of Traders’ Associations (GUTA) to guide businesses on VAT record-keeping, input tax claims and correct pricing.

The Authority indicated its readiness to extend similar technical support to the Abossey Okai Spare Parts Traders Association and other trade groups, urging stakeholders to engage constructively as the reforms take effect.

Ghana IMF programme performance highlights path to sustainable recovery