The Social Security and National Insurance Trust (SSNIT) has announced plans to attract strategic investors to support two of its underperforming hotels—La Palm Royal Beach Hotel in Accra and Elmina Beach Resort in the Central Region—as part of efforts to revitalize its hospitality portfolio.

The disclosure was made by SSNIT Director-General, Mr. Kwesi Afreh Biney, when he appeared before the Public Accounts Committee (PAC) of Parliament on November 7, 2025. The move, he explained, aims to improve operational efficiency, restore profitability, and protect contributors’ funds invested in the hotel chain.

According to Mr. Biney, the search for investors will focus specifically on hotels within the Golden Beach Hotels Group that have struggled financially over the years.

“We are seeking a strategic investor for La Palm Beach Hotel and *Elmina Beach Resort,” he stated. “However, for **SSNIT Guest House, **Ridge Royal, and *Labadi Beach Hotel, we do not intend to seek any strategic support. We believe these three hotels should be allowed to run on their own.”

The SSNIT boss clarified that the profitable entities in the Trust’s portfolio—particularly *Labadi Beach Hotel—will not be part of the investment drive. Labadi, he revealed, has remained one of SSNIT’s most successful assets, recording a profit of about *GH₵80 million in 2024 and paying GH₵16 million in dividends in 2023.

“Labadi Beach Hotel continues to perform well, consistently generating profits and paying dividends. There are no plans to bring in a partner for that entity,” Mr. Biney added.

SSNIT: Reviving the Golden Beach Portfolio

The Golden Beach Hotels Group, which is fully owned by SSNIT, oversees several hospitality properties across Ghana, including La Palm Royal Beach Hotel, Elmina Beach Resort, Ridge Royal Hotel, and Labadi Beach Hotel.

While some have remained profitable, others have struggled in recent years due to high operational costs, outdated infrastructure, and a slowdown in tourism caused by global economic shocks and domestic inflationary pressures.

Analysts say the hospitality sector’s recovery since the COVID-19 pandemic has been uneven, with Ghana’s average hotel occupancy rate hovering around 55% in 2024, compared to over 70% before 2020. This has strained mid- and high-tier hotels that depend heavily on international tourists and corporate clients.

Mr. Biney told PAC that SSNIT’s goal is to bring in private expertise and capital to reposition the underperforming properties for competitiveness. The partnership, he noted, would not mean an outright sale but rather a strategic collaboration aimed at maximizing returns.

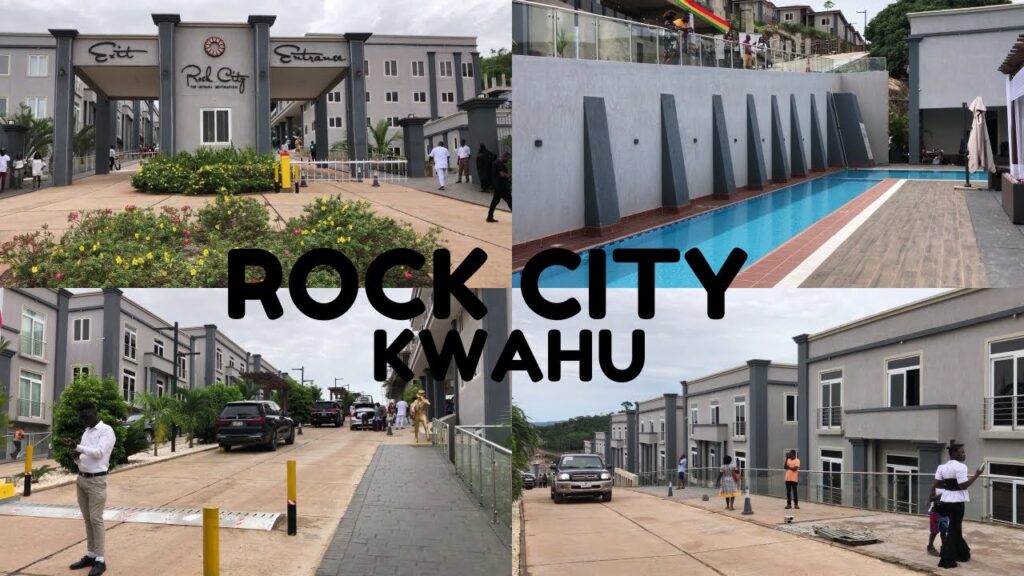

SSNIT’s hotel investments became a subject of national debate in 2024, following reports that the Trust had initiated talks to sell a 60% stake in four of its hotels—La Palm Beach Hotel, Labadi Beach Hotel, Ridge Royal Hotel, and Elmina Beach Resort—to Rock City Hotel Limited, a company owned by Dr. Bryan Acheampong, Minister for Food and Agriculture and Member of Parliament for Abetifi.

The proposed sale sparked public outrage and parliamentary scrutiny, with critics—led by North Tongu MP Samuel Okudzeto Ablakwa—questioning the transparency and fairness of the process. Organised Labour also opposed the transaction, warning of a possible nationwide strike if the sale proceeded.

In response to the backlash, Rock City Hotel formally withdrew its bid, and SSNIT subsequently suspended the sale. The Trust then pledged to reassess its strategy for managing the hotels, opting for a more consultative approach moving forward.

The renewed search for strategic partners reflects SSNIT’s attempt to strike a balance between maintaining public confidence and ensuring sustainable management of pension funds.

With assets exceeding GH₵13 billion, SSNIT is one of Ghana’s largest institutional investors, responsible for managing retirement contributions from more than 1.7 million workers. Its investment decisions therefore carry significant national implications.

Economist Dr. Patrick Asuming of the University of Ghana Business School notes that while public concerns about privatization are valid, SSNIT’s diversification into profitable partnerships could help secure long-term value for contributors.

“Public pension funds must be managed prudently, but they also need to evolve. If private partnerships bring capital and better management practices, it can be beneficial,” he said.

The tourism and hospitality industry remains a crucial component of Ghana’s economy, contributing about 5.5% to GDP and employing over 600,000 people, according to the Ghana Tourism Authority (GTA).

However, persistent challenges such as inadequate maintenance, high utility costs, and limited marketing have weakened the competitiveness of state-owned hotels. While private hotel chains like Kempinski Gold Coast City, Rock City, and African Regent continue to attract clientele, several public establishments struggle to maintain standards.

Tourism experts have urged SSNIT to pursue management partnerships that preserve Ghanaian ownership while introducing efficiency and innovation. “We need models that keep assets Ghanaian-owned but internationally managed,” said a hospitality consultant based in Accra.

During the PAC session, members of Parliament asked SSNIT to ensure that any investor selection process is transparent and competitive. Mr. Biney assured the committee that lessons had been learned from past controversies and that due diligence and public procurement laws would guide all future negotiations.

The Director-General also reiterated SSNIT’s commitment to publishing audited financial statements and engaging key stakeholders—including Organised Labour—before finalizing any partnerships.

SSNIT’s renewed effort to bring investors into La Palm Beach Hotel and Elmina Beach Resort reflects a pragmatic shift toward balancing profitability with accountability. As the Trust works to protect pension funds amid Ghana’s challenging economic climate, the coming months will test whether strategic partnerships can revive state-owned hospitality assets without repeating the mistakes of the past.

For contributors and the broader public, transparency and sound management will remain the measure of success.

Read also: Man Found Dead in Amansie West Mining Pit After Dispute Over Missing GH₵1,000 with a Sex Worker