Table of Contents

Crypto Virtual Cards Redefining Financial Access and KYC in Africa

A new wave of digital finance innovation is transforming how people verify their identity and spend money online. Crypto virtual cards — linked to digital wallets rather than bank accounts — are offering an alternative to traditional banking by simplifying Know Your Customer (KYC) requirements for small-scale users.

Across Africa, where millions remain unbanked or face challenges with conventional verification systems, these tools are reshaping how people access digital services and make everyday payments.

A Simpler Path to Digital Payments

Crypto virtual cards enable users to spend cryptocurrencies such as stablecoins on online services — from streaming subscriptions and e-commerce purchases to food delivery and travel bookings. Unlike traditional debit cards tied to bank accounts, these virtual cards draw directly from a user’s crypto balance, enabling faster and borderless transactions.

The approach has gained traction in countries like Ghana and Nigeria, where digital wallets and mobile payments are already widely used. For many young people, freelancers, and small entrepreneurs, the simplified process reduces the barriers of lengthy KYC verification, which can delay access to online financial tools.

African Innovations Leading the Shift

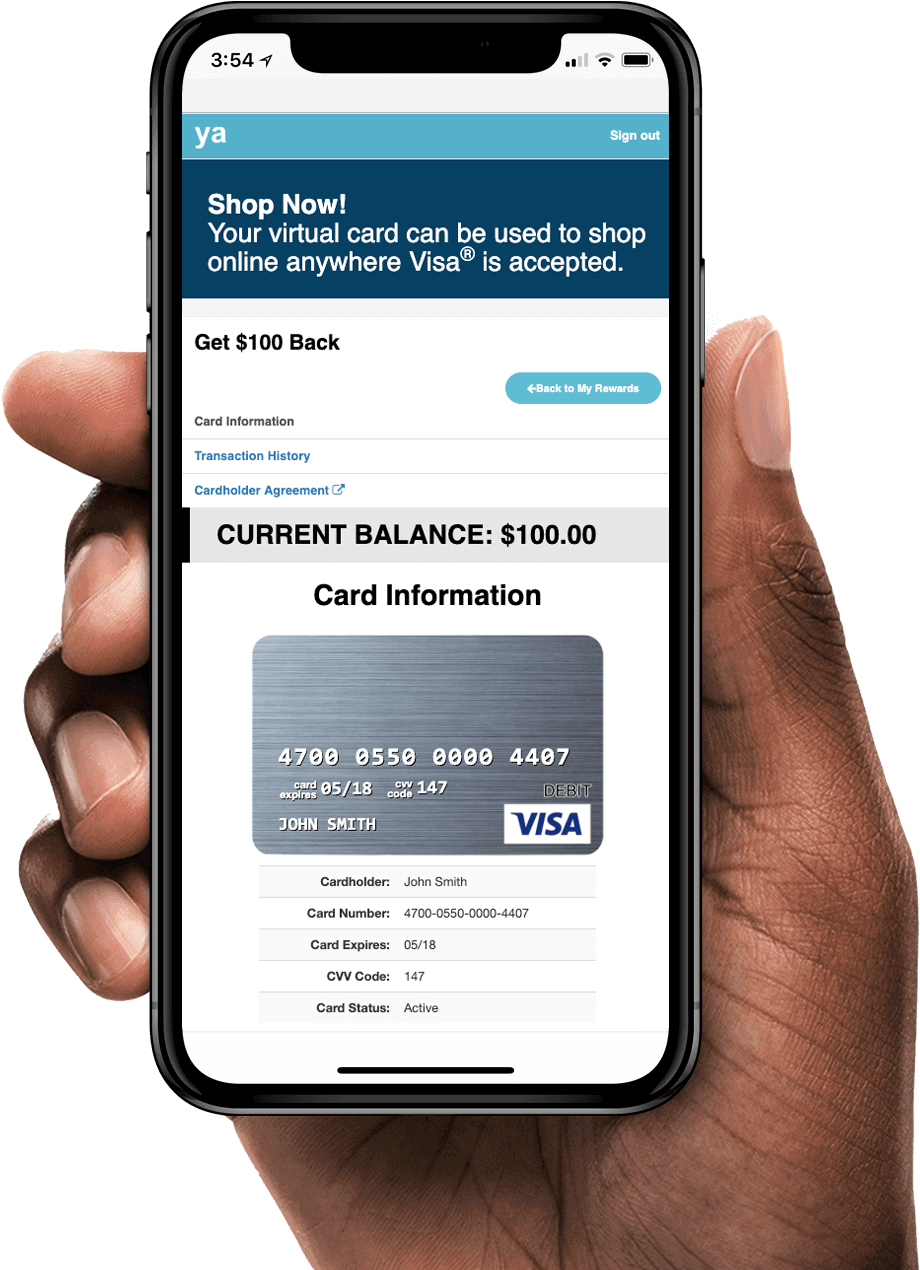

One key example of this innovation is Bitsika, a Ghana-based fintech company offering a crypto virtual Visa debit card through its mobile app. The platform allows users to fund their cards with stablecoins such as USDT, making online purchases and subscriptions possible without the heavy documentation that traditional banks often require.

Bitsika’s tiered verification model reflects a growing belief in “smart KYC” — where verification levels match user activity rather than applying a single standard for all. This means a student making small monthly payments faces a lighter process compared to a business handling high-value transfers.

“Financial safety is vital, but so is inclusion,” a fintech analyst in Accra noted. “Platforms like Bitsika show that it’s possible to design systems that secure transactions without shutting out low-income or first-time users.”

A Global Trend With Local Impact

The adoption of crypto virtual cards isn’t limited to Ghana. Global platforms such as Bitrefill have also demonstrated how digital currencies can be used for gift cards and everyday purchases. This trend underscores a broader shift toward financial systems that prioritize accessibility and convenience.

In Africa, where nearly 57% of adults remain unbanked, according to the World Bank’s Global Findex Report (2021), crypto-based financial tools are offering new paths to inclusion. They provide flexible options for people excluded by formal banking — whether due to lack of documentation, distance from banking facilities, or limited income history.

Balancing Security and Freedom

While regulatory compliance remains crucial, experts argue that the evolution of KYC should reflect real-world user needs. Simplified onboarding processes for low-risk users can enhance trust while keeping the system secure.

Crypto virtual cards are proving that identity verification does not have to be a barrier to innovation. Instead, it can evolve into a model that promotes responsible financial participation without compromising safety.

As digital payments continue to rise across Africa — projected by Statista to exceed US$200 billion in transaction value by 2026 — the demand for flexible, user-friendly financial tools will only increase. Fintechs like Bitsika are positioning themselves at the center of this evolution, bridging the gap between traditional finance and the decentralized future.

The growing use of crypto virtual cards demonstrates that technology can expand access to secure, efficient, and inclusive financial systems. For Ghana and the wider continent, this trend represents not just a technological leap but a social one — where financial empowerment becomes more accessible to everyone, not just the few with formal bank accounts.

Read also: Tolon MP Demands Transparency as Government Delays Report on Fatal Helicopter Crash